Below is a list of some of the 20 most popular genuine instant loan apps in Kenya, including Tala, Branch, Zenka, Okash, and KCB M-Pesa.

- FlashPesa

- Zash Loan

- KCB M-Pesa

- MCo-op Cash

- Timiza App by KCB

- Equity Eazzy App

- Mshwari Loan

- Berry Loan App

- Pesa Pap

- Stawika Loan

- Hustler Fund

- Fuliza Mpesa

- Tala

- Branch

- Zenka

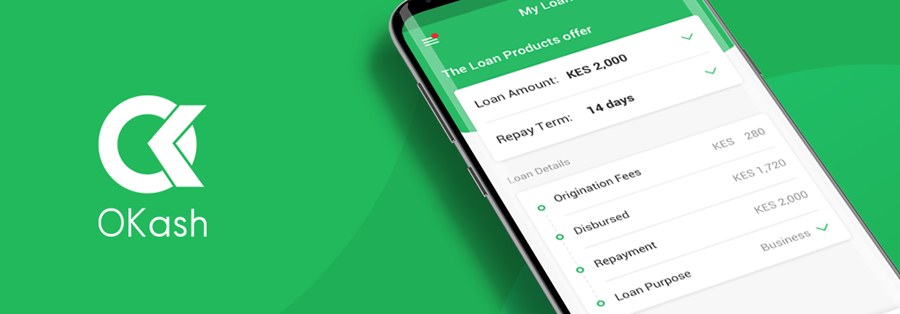

- Okash

- Zidisha

- Haraka

- Saidia

- iPesa

- KashPlus

- Fanaka

- Zawadi

Things to Consider When Searching for Loan Apps in Kenya

When looking for instant loan apps in Kenya, it is important to research and only use trusted and reputable lenders. Here are some tips on how to find genuine instant loan apps:

#1 Research the Lender

Before applying for a loan with any lender, it is important to research their reputation and history. Check if they are registered with the Central Bank of Kenya and have a good track record of lending.

#2 Check Reviews

Look for reviews from other borrowers who have used the app before. Check out their social media pages and online forums to see what others say about their services.

#3 Transparency

Ensure the lender is transparent about their fees, interest rates, and repayment terms. They should clearly state all charges associated with the loan upfront.

#4 Loan Limits

It is important to check the loan limits before applying for a loan. Make sure that the lender offers the amount you need.

#5 Customer Support

Look for a lender that offers good customer support. This will ensure that you can get help whenever you need it.

FAQs: Genuine Instant Loan Apps in Kenya

Which is the fastest loan app in Kenya?

Zenka and Zash Loan are considered the fastest loan apps in Kenya.

Which app can give you a loan in Kenya?

Many mobile lending apps in Kenya provide genuine instant loans. These include Tala, Branch, Timiza, Fuliza, and KCB Mpesa.

Which is the best app to borrow money?

Equity Eazzy App, Mshwari Loan, Branch, Zenka, Okash, Zidisha, and Haraka are some of Kenya’s best apps to borrow money from.

What are instant loan apps in Kenya?

Instant loan apps are mobile applications that allow you to apply for and receive loans quickly and easily using your smartphone. These apps offer short-term loans, typically with a repayment period of 14 to 30 days, and often with high-interest rates.

How do instant loan apps work in Kenya?

Instant loan apps in Kenya provide borrowers with quick access to small loans through mobile phones. The borrower fills out an application through the app and receives a decision on their loan within minutes. The loan is disbursed to their mobile wallet or bank account if approved.

Are instant loan apps in Kenya safe?

Yes, instant loan apps in Kenya can be safe if you choose a reputable lender. Doing your research and only using trusted and registered lenders is important.

What are the interest rates on instant loans in Kenya?

Interest rates on instant loans in Kenya vary depending on the lender and the amount borrowed. Checking the interest rates and fees before applying for a loan is important.

Can I get an instant loan if I have a bad credit score?

Yes, some instant loan apps in Kenya offer loans to people with bad credit scores. However, the interest rates may be higher for borrowers with poor credit history.

How long does it take to get an instant loan in Kenya?

Instant loans are usually disbursed within minutes or hours after approval. However, depending on the lender and the information required, the application process may take longer.

What documents do I need to apply for an instant loan in Kenya?

The documents required for an instant loan in Kenya may vary depending on the lender. However, most lenders require a valid ID and proof of income. Some lenders may also require a bank statement and a mobile phone number.

- See Also: Latest Mpesa Charges in Kenya 2023

Conclusion

Instant loan apps in Kenya have become a popular option for borrowers who need quick access to funds. While these apps can provide a convenient way to obtain short-term loans, it’s important to research and uses only reputable lenders.

By checking the lender’s reputation, reading reviews, and being aware of the fees and interest rates, you can decide which instant loan app to use. Remember only to borrow what you can afford to repay and to use these loans responsibly. With careful consideration and responsible use, instant loan apps can manage unexpected expenses or bridge cash flow gaps.